To Create Wealth Effectively You Need An Effective Wealth Strategy

For a financial strategy to be effective, it needs to provide you with a specific, measurable and relevant answer to three essential questions:

-

What is the financial outcome that I desire?

-

What is the size of the gap between my current situation and my desired outcome?

-

What is the most effective course of action to achieve the desired outcome?

How Do You Create an Effective Financial Strategy?

Creating a financial strategy is a lot like preparing for a sailing race. It isn’t necessary to have a plan – and of course a plan does not guarantee financial success or that you’ll win the race. However, a successful sailor would never embark on a voyage or compete in a race without a plan.

The voyage rarely goes to plan. The winds and currents change often. There’ll be rough seas and days without wind. But the odds of reaching your objective increase greatly if you are prepared, adaptable, patient, and can learn from your experiences.

Without a plan and a clear sense of your destination, you run the risk of becoming lost, confused and ill-prepared for challenges that may come your way.

Likewise, creating an effective plan is based on five simple questions:

-

How much wealth do you need?

-

What is your current financial position?

-

How big is the difference between what you have and what you need?

-

How much time is available to make up the difference?

-

What courses of action are available to you?

The first question is easy to determine if you use your current lifestyle as the basis to calculate your future income need. Basically, the cost of your future lifestyle will be similar to your current lifestyle excluding extraordinary expenses, such as your home mortgage or private schooling.

The second question likewise is easy to determine since the answer at any point in time is the dollar value of known assets today minus the dollar value of all liabilities today.

The other questions require some specialist knowledge to determine what options are realistically available, but are not as difficult to answer as it may first appear. Getting the right answers often depends on asking the right questions. A few questions to start with are:

-

How much surplus income do I have to save or to service an investment loan?

-

How much time do I have to withstand challenging economic conditions and difficult markets?

-

What is the amount of loss from which I could not recover?

-

Are there any savings or investment schemes that have favourable taxation consequences?

You also need a good financial planning tool to model various scenarios and ideas on paper to see how they would work out before you risk any capital.

Financial Planning Tool

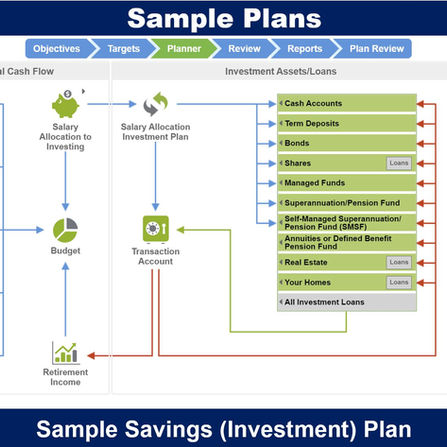

We have partnered with Financial Mappers to provide you with an effective, easy-to-use Financial Planning Tool that you can use to create your own Financial Plan.

The Financial Mappers tool captures all your relevant information and data regarding your current financial position and applies sophisticated financial equations to generate your personal financial "map".

Financial Mappers includes projection tools that you can use to model and compare different strategies, such as Paying the Mortgage vs Contributing to Super.

Financial Mappers also includes a Financial Literacy Program consisting of 36 lessons which explains basic financial concepts - e.g. compound interest, loans, insurance, inflation, etc.); how to define and manage your financial objectives; and provides information on advanced concepts (e.g. superannuation, shares, gearing etc.).

Need Assistance?

Importantly, if you need assistance or require complex financial advice, an Adviser is just a "click" away.

Before you register for Financial Mappers, it is recommended that you take the time to watch the following videos, and become familiary with the features of the Financial Mappers software.

Financial Mappers Subscription Fee

The annual Financial Mappers subscription fee is $347 (incl GST)*

This fee includes:

-

12-month access to Financial Mappers software

-

Over 20 downloadable personal financial reports

-

Financial Literacy Programs delivered over the 12-months

-

Option to share your plan with a financial adviser

*You will receive a 20% discount if you register with FinancialStrategy.com.au and follow our social pages.

Getting Started Guide

How to Register

Registration is simple. All the information you need to get started is:

-

Full name

-

Email address

Follow these simple steps to get your 20% discount:

-

Click the registration button below

-

Register your name and email address on the "Follow Us & Receive 20% Off Financial Mappers" page

-

You will be sent an email with your discount code and link to the Financial Mappers Registration Page.

Click the button below to start preparing your financial plan.